As Car Insurance Discounts Many Drivers Don’t Know About takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Car insurance discounts can be a hidden gem for many drivers, offering significant savings that are often overlooked. In this comprehensive guide, we will delve into various types of discounts, eligibility criteria, lesser-known discounts, bundling benefits, and loyalty rewards that can help drivers maximize their savings. Stay tuned to uncover the secrets of saving on your car insurance premiums!

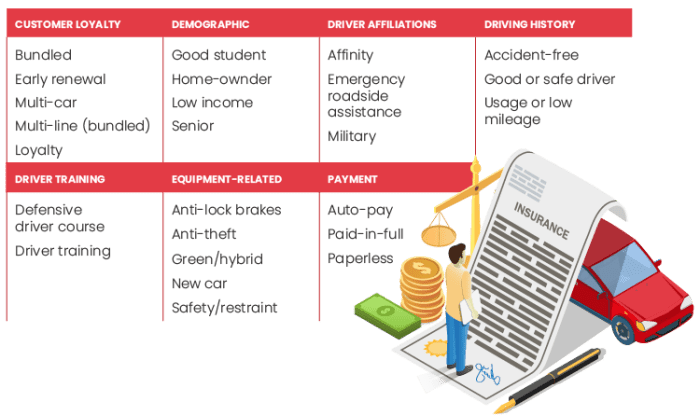

Types of Car Insurance Discounts

Car insurance discounts can help drivers save money on their premiums. Here are some common types of discounts that many drivers may not be aware of:

Multi-Policy Discount

Some insurance companies offer a multi-policy discount for customers who have more than one type of insurance policy with the same provider. For example, if you have both car insurance and homeowners insurance with the same company, you may be eligible for a discount on both policies.

Good Student Discount

Students who maintain good grades in school may qualify for a good student discount on their car insurance. This discount is typically available to high school and college students who meet certain academic criteria.

Usage-Based Insurance Discount

Usage-based insurance programs track your driving habits using a device installed in your car or a mobile app. Drivers who demonstrate safe driving behaviors, such as obeying speed limits and avoiding sudden stops, may be eligible for a discount based on their driving data.

Paperless Billing Discount

Some insurance companies offer discounts to customers who choose to receive their bills and policy documents electronically, rather than by mail. Going paperless can help reduce administrative costs for the insurer, leading to savings that are passed on to the policyholder.

Eligibility Criteria for Discounts

When it comes to car insurance discounts, there are various eligibility criteria that drivers need to meet in order to qualify for savings on their premiums. These criteria can vary depending on the type of discount being offered.Age-Based Discounts vs. Driving Record-Based Discounts

- Age-Based Discounts:

- Young Driver Discounts: Typically offered to drivers under the age of 25 who have completed a driver training course.

- Senior Driver Discounts: Available to drivers over a certain age, usually 50 or 55, who have a clean driving record.

- Driving Record-Based Discounts:

- Good Driver Discounts: Offered to drivers with a clean driving record, often defined as no accidents or traffic violations within a specific time frame.

- Defensive Driving Course Discounts: Drivers who have completed a defensive driving course may be eligible for a discount on their insurance premiums.

Qualifying for Multiple Discounts

To qualify for multiple discounts simultaneously, drivers should carefully review the eligibility requirements for each discount offered by their insurance provider. By maintaining a good driving record, completing training courses, and meeting age-based criteria, drivers can maximize their savings on car insurance premiums. It's important to communicate with your insurance agent to ensure you are taking advantage of all available discounts for which you qualify.Lesser-Known Discounts

When it comes to car insurance discounts, there are some lesser-known ones that many drivers may not be aware of. These discounts can help you save money on your premiums if you meet certain criteria or have specific safety features installed in your vehicle.

Vehicle Safety Features Discounts

Insurance companies often offer discounts for vehicles equipped with safety features that reduce the risk of accidents or injuries. Some common safety features that may make you eligible for a discount include:

- Anti-lock brakes

- Electronic stability control

- Adaptive cruise control

- Lane departure warning systems

- Automatic emergency braking

Having these safety features installed in your vehicle can not only keep you safe on the road but also help you qualify for discounts on your car insurance premiums.

Anti-Theft Devices Discounts

Another lesser-known discount that insurance companies offer is for vehicles equipped with anti-theft devices. These devices help reduce the risk of your car being stolen, which can lower the chances of you needing to file a claim with your insurance company. Some common anti-theft devices that may make you eligible for a discount include:

- Car alarms

- Immobilizers

- GPS tracking systems

- Steering wheel locks

- Ignition cut-off systems

By having these anti-theft devices installed in your vehicle, you not only protect your car from theft but also potentially qualify for discounts on your car insurance premiums.

Tips for Inquiring About Lesser-Known Discounts

If you're interested in exploring these lesser-known discounts further, here are some tips on how you can inquire about and leverage them:

- Reach out to your insurance provider and ask specifically about discounts related to safety features and anti-theft devices.

- Provide documentation or proof of the safety features and anti-theft devices installed in your vehicle to ensure you receive the applicable discounts.

- Ask about any other discounts that may not be widely advertised but could be applicable to your situation, such as discounts for low-mileage drivers or good students.

Being proactive and asking your insurance company about these lesser-known discounts can help you maximize your savings on car insurance premiums.

Bundling Discounts

When it comes to car insurance discounts, one strategy that many drivers overlook is bundling discounts. This involves combining multiple insurance policies with the same provider to receive a discount on each policy.

When it comes to car insurance discounts, one strategy that many drivers overlook is bundling discounts. This involves combining multiple insurance policies with the same provider to receive a discount on each policy.Benefits of Bundling Auto Insurance

By bundling your auto insurance with other policies like home insurance or renters insurance, you can often enjoy significant cost savings. Insurance companies offer these discounts as an incentive to customers to consolidate their policies with them. This not only simplifies your insurance management but also helps you save money in the process.- One of the key benefits of bundling is the convenience it offers. Instead of dealing with multiple insurance providers for different policies, you can have all your policies under one roof, making it easier to manage and track.

- Bundling insurance policies can also lead to substantial cost savings. Insurance companies typically offer discounts ranging from 5% to 25% when you bundle multiple policies. This can result in significant savings on your overall insurance premiums.

- Moreover, bundling can also streamline the claims process. In the event of a claim that involves multiple policies, having them bundled with the same insurer can simplify the process and ensure a smoother claims experience.

Loyalty Discounts

Many insurance providers offer loyalty discounts as a way to reward long-term customers for their continued business. These discounts are designed to incentivize drivers to stay with the same insurance company over time.

Benefits of Loyalty Programs

- Discounted Premiums: Long-term customers may be eligible for reduced insurance premiums as a reward for their loyalty.

- Accident Forgiveness: Some insurance companies offer accident forgiveness programs for loyal customers, allowing them to maintain their good driving record even after a mishap.

- Increased Coverage: Loyalty rewards may include additional coverage options or higher coverage limits at no extra cost.

Examples of Loyalty Rewards

Renewal Discounts: Customers who renew their policy with the same insurance provider may receive a discount on their premium.

Multi-Policy Discounts: Drivers who have multiple insurance policies with the same company, such as auto and home insurance, may be eligible for additional savings.

Reward Points: Some insurance companies offer loyalty reward points that can be redeemed for discounts, gift cards, or other perks.

Summary

In conclusion, Car Insurance Discounts Many Drivers Don’t Know About are a valuable resource that can lead to substantial cost savings for policyholders. By exploring the different types of discounts, eligibility criteria, and lesser-known savings opportunities, drivers can make informed decisions to optimize their insurance coverage while keeping their expenses in check. Don't miss out on potential savings – take advantage of these lesser-known discounts today and start saving on your car insurance premiums!

Q&A

Question: What are some common types of car insurance discounts that many drivers may not be aware of?

Answer: Some common types of discounts include safety feature discounts, low mileage discounts, loyalty discounts, and bundling discounts.

Question: How can drivers qualify for multiple discounts simultaneously?

Answer: Drivers can qualify for multiple discounts by meeting the criteria for each discount offered by the insurance provider. For example, having a safe driving record can make a driver eligible for both a safe driver discount and a low mileage discount.

Question: What are some lesser-known discounts related to vehicle safety features?

Answer: Lesser-known discounts related to vehicle safety features may include discounts for anti-lock brakes, electronic stability control, and adaptive headlights.

Question: How do loyalty discounts benefit long-term customers?

Answer: Loyalty discounts benefit long-term customers by offering reduced premiums, special rewards, and additional coverage options as a token of appreciation for their continued business.

Question: What is the concept of bundling discounts for car insurance?

Answer: Bundling discounts involve combining multiple insurance policies, such as auto insurance and home insurance, with the same provider to receive a discounted rate on each policy.