Delving into Bundled Auto Insurance Plans: Pros, Cons, and Savings, this introductory paragraph aims to pique the interest of readers with a detailed yet engaging overview of the topic.

Further elaborating on the concept and benefits of bundled auto insurance plans.

Introduction to Bundled Auto Insurance Plans

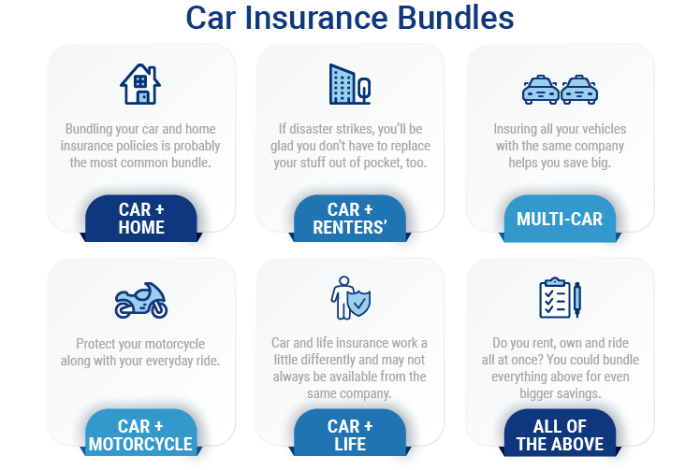

When it comes to insurance, bundled auto insurance plans are a popular choice for many consumers. These plans combine different types of coverage, such as auto insurance, homeowners insurance, and more, into one convenient package. By opting for bundled auto insurance plans, policyholders can enjoy a variety of advantages.

Definition of Bundled Auto Insurance Plans

Bundled auto insurance plans refer to the practice of combining multiple insurance policies under one provider. This typically includes auto insurance, along with other types of coverage like home insurance, renters insurance, or even life insurance. By bundling these policies together, policyholders can often receive discounts and other benefits.

Advantages of Opting for Bundled Auto Insurance Plans

- Cost Savings: One of the key advantages of bundled auto insurance plans is the potential for cost savings. Insurance companies often offer discounts to policyholders who choose to bundle multiple policies together. This can result in significant savings on premiums.

- Convenience: Bundled auto insurance plans make managing multiple policies easier. Instead of dealing with different providers for each type of coverage, policyholders can have all their insurance needs met by a single company. This simplifies the process and reduces the likelihood of gaps in coverage.

- Customization: Despite bundling policies, insurance providers still offer the flexibility to customize coverage to suit individual needs. Policyholders can choose the types and levels of coverage that best fit their requirements, ensuring they are adequately protected.

Pros of Bundled Auto Insurance Plans

When it comes to bundled auto insurance plans, policyholders can benefit in various ways. From cost savings to convenience, there are several advantages to consider.

When it comes to bundled auto insurance plans, policyholders can benefit in various ways. From cost savings to convenience, there are several advantages to consider.Potential Cost Savings for Policyholders

- Bundling multiple insurance policies, such as auto and home insurance, with the same provider often leads to discounts.

- Insurers may offer lower rates for customers who have multiple policies with them, ultimately resulting in cost savings for policyholders.

- By consolidating policies, individuals can maximize their savings and potentially reduce their overall insurance costs.

Convenience of Having All Coverages Under One Policy

- With a bundled auto insurance plan, policyholders can have all their coverages, such as liability, collision, and comprehensive, under a single policy.

- This simplifies the insurance process, as individuals only need to manage one policy and make a single payment for all their coverages.

- Having all coverages in one place can make it easier to track and manage insurance policies, saving time and reducing administrative hassle.

Bundling Can Lead to Discounts from Insurers

- Insurers often incentivize customers to bundle their insurance policies by offering discounts on premiums.

- By combining multiple policies, policyholders may qualify for a discount on each policy, resulting in significant savings over time.

- These discounts can make bundled auto insurance plans a cost-effective option for individuals looking to save money on their insurance coverage.

Cons of Bundled Auto Insurance Plans

While bundled auto insurance plans offer several benefits, there are also some drawbacks to consider before making a decision.

Lack of Customization Options

One of the main disadvantages of bundled auto insurance plans is the lack of customization options

Potential Cost Inefficiencies

In some cases, bundling auto insurance with other types of coverage may not always result in cost savings. Depending on individual circumstances, such as driving record, location, or vehicle type, separate policies for auto insurance and other types of coverage could potentially be more cost-effective. It is important for consumers to carefully compare quotes and evaluate whether bundling is truly the best financial option for them.

Restrictions on Coverage Choices

Another downside of bundled auto insurance plans is the potential restrictions on coverage choices. Policyholders may find that certain add-ons or specialized coverage options are not available when opting for a bundled plan. This limitation could prevent individuals from obtaining the specific protections they desire or require for their unique circumstances.

Factors Influencing Savings with Bundled Auto Insurance

When it comes to bundled auto insurance plans, savings can vary based on a variety of factors. Insurers take into account several key elements to determine the discounts offered to policyholders. Let's explore some of the factors that influence savings with bundled auto insurance.Driving Record Impact

One of the primary factors that can impact savings with bundled auto insurance plans is the policyholder's driving record. Insurers typically offer higher discounts to drivers with a clean record free of accidents or traffic violations. A history of safe driving demonstrates lower risk for the insurer, which can lead to more significant savings for the policyholder.

Role of Insured Vehicles

The types of vehicles insured under a bundled auto insurance plan also play a crucial role in determining the discounts offered. Safer and more reliable vehicles with advanced safety features may qualify for higher discounts due to the reduced risk of accidents or damages. Insurers consider the make, model, year, and safety features of the insured vehicles when calculating bundled plan savings.

Additional Criteria for Discounts

In addition to driving record and insured vehicles, insurers may take into account other criteria to determine bundled plan discounts. Factors such as the policyholder's age, location, mileage driven, and even credit score can influence the savings offered. Younger drivers, those living in high-risk areas, or individuals with poor credit may receive lower discounts compared to older, more experienced drivers with good credit.

Closure

Concluding this discussion on Bundled Auto Insurance Plans: Pros, Cons, and Savings with a concise summary that encapsulates the key points covered, leaving readers informed and intrigued.

FAQ Compilation

What type of coverage is typically included in bundled auto insurance plans?

Bundled auto insurance plans usually combine coverage for auto liability, collision, comprehensive, and sometimes other types of coverages under a single policy.

Are there any disadvantages to opting for bundled auto insurance plans?

One potential drawback is the limited customization options compared to separate policies. Additionally, bundled plans may not always be the most cost-effective choice for every driver's unique situation.

How can a driver's driving record impact savings with bundled auto insurance plans?

A driver with a clean record is likely to receive better discounts and savings compared to someone with a history of accidents or traffic violations. Insurers often consider driving history when determining discounts.