Delve into the world of Bundled Auto Insurance Plans: Pros, Cons, and Savings as we uncover the advantages and disadvantages of this insurance option.

Learn about the potential savings and unique features that come with bundling your auto insurance policies.

Introduction to Bundled Auto Insurance Plans

Bundled auto insurance plans refer to packages that combine different types of insurance policies, such as auto, home, and life insurance, into a single plan offered by the same provider.

These plans work by allowing customers to purchase multiple insurance policies from the same company, which often results in cost savings and convenience.

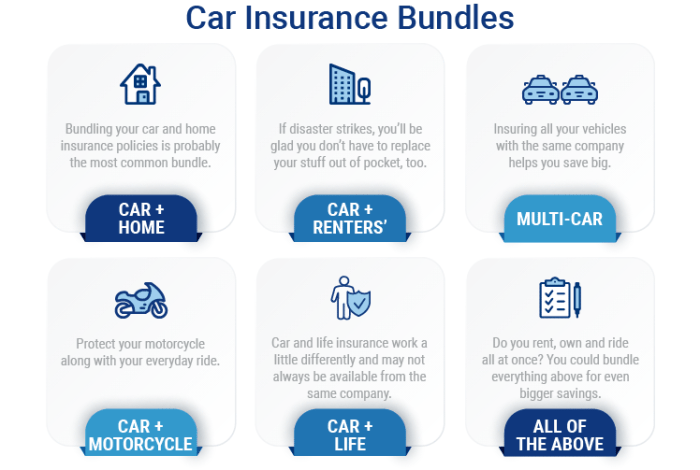

Examples of Common Bundled Auto Insurance Packages

- Auto and Home Insurance Bundle: This package combines coverage for both your home and car, providing comprehensive protection for your most valuable assets.

- Auto and Life Insurance Bundle: By bundling auto and life insurance, you can ensure financial security for your loved ones in case of an unfortunate event.

- Auto, Home, and Life Insurance Bundle: This comprehensive package offers coverage for your car, home, and life, simplifying your insurance needs and potentially saving you money.

Pros of Bundled Auto Insurance Plans

When considering bundled auto insurance plans, there are several advantages that policyholders can benefit from.Bundling auto insurance with other policies like home or renters insurance can lead to significant cost savings. Insurance companies often offer discounts to customers who choose to bundle their policies, resulting in lower overall premiums.One of the key benefits of bundled plans is the simplification of insurance management. Instead of dealing with multiple insurance companies for different policies, customers can conveniently manage all their insurance needs in one place. This can save time and reduce the hassle of keeping track of multiple policies and payments.

When considering bundled auto insurance plans, there are several advantages that policyholders can benefit from.Bundling auto insurance with other policies like home or renters insurance can lead to significant cost savings. Insurance companies often offer discounts to customers who choose to bundle their policies, resulting in lower overall premiums.One of the key benefits of bundled plans is the simplification of insurance management. Instead of dealing with multiple insurance companies for different policies, customers can conveniently manage all their insurance needs in one place. This can save time and reduce the hassle of keeping track of multiple policies and payments.Potential Cost Savings

- Bundling auto insurance with other policies can lead to discounted rates, resulting in overall cost savings for policyholders.

- Insurance companies may offer loyalty discounts or incentives for customers who bundle multiple policies with them.

Simplified Insurance Management

- Having all insurance policies with one provider makes it easier to manage payments, updates, and claims.

- Policyholders can enjoy the convenience of a single point of contact for all their insurance needs.

Streamlined Claims Processes

- With bundled auto insurance plans, the claims process is often more streamlined and efficient, as all policies are handled by the same insurer.

- Policyholders may experience quicker claims resolution and a smoother overall claims experience.

Cons of Bundled Auto Insurance Plans

When considering bundled auto insurance plans, it's essential to acknowledge that they may not be the ideal choice for everyone. While there are several benefits to bundling policies, there are also some potential drawbacks to be aware of.Lack of Customization Options

When you opt for a bundled auto insurance plan, you are essentially combining multiple policies into one package. While this can simplify your insurance management and potentially save you money, it may also mean that you have limited options for customization. If you have specific coverage needs or want to tailor your policies to fit your unique situation, standalone policies may offer more flexibility in terms of coverage choices.Less Flexibility in Coverage Selection

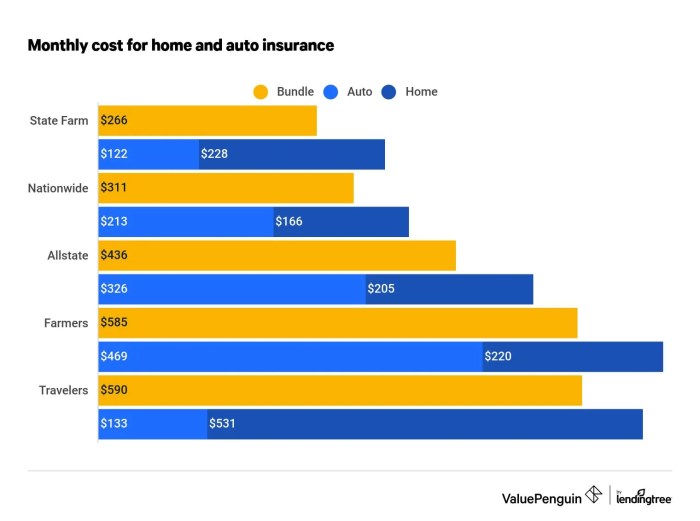

Bundled auto insurance plans typically come with a set package of coverages for all included policies. This means that you may not have the same level of control over the types and amounts of coverage for each policy as you would with standalone policies. In some cases, this lack of flexibility could leave you underinsured in certain areas or paying for coverage that you don't necessarily need.Potential for Higher Costs in Some Cases

While bundled auto insurance plans are often marketed as a cost-effective option, they may not always result in the lowest premiums for every driver. Depending on your individual circumstances, such as driving record, location, or type of vehicle, you may find that standalone policies from different insurers could offer better rates. It's crucial to compare quotes from multiple providers to ensure you're getting the best deal for your specific situation.Factors Influencing Savings with Bundled Auto Insurance

When it comes to bundled auto insurance plans, the amount saved can vary based on several key factorsType of Coverage

- The types of coverage included in a bundled auto insurance plan can significantly impact the potential savings. Bundling together policies for auto, home, and other insurance needs can often result in higher discounts compared to bundling just auto policies.

- Combining comprehensive and collision coverage with liability insurance under a single bundled plan can also lead to increased savings, as insurers may offer more competitive rates for bundled packages.

Driving Record

- Individuals with a clean driving record typically stand to benefit the most from bundled auto insurance plans. Insurers often reward safe drivers with lower premiums and additional discounts for maintaining a history of responsible driving.

- On the other hand, individuals with a history of accidents, traffic violations, or claims may see less significant savings with bundled plans. Insurers may view higher-risk drivers as less desirable candidates for bundled discounts.

Number of Vehicles

- Households with multiple vehicles can also experience increased savings by bundling all cars under a single insurance policy. Insurers may offer multi-vehicle discounts as part of bundled plans, leading to overall cost savings for policyholders.

- By insuring all vehicles under a single bundled plan, individuals can streamline their insurance management and potentially benefit from reduced rates compared to insuring each vehicle separately.

Tips for Maximizing Savings with Bundled Auto Insurance

When it comes to bundled auto insurance plans, there are several strategies you can employ to maximize your savings and get the best value for your money.Optimizing Savings through Bundling

- Combine multiple policies: Bundling your auto insurance with other types of insurance, such as home or renters insurance, can often lead to significant discounts.

- Review your coverage: Make sure you are not paying for coverage you don't need. Customize your bundled insurance plan to fit your specific needs and eliminate any unnecessary add-ons.

- Shop around: Compare bundled insurance plans from different providers to find the best rates and coverage options. Don't settle for the first offer you receive.

Evaluating if Bundling is the Right Choice

- Assess your insurance needs: Consider your current insurance needs and whether bundling will provide the right amount of coverage for your assets and liabilities.

- Calculate potential savings: Use online tools or consult with insurance agents to estimate the savings you could achieve by bundling your policies.

- Consider convenience: Think about the convenience of having all your insurance policies with one provider. If bundling simplifies your insurance management, it may be the right choice for you.

Negotiating Better Rates when Bundling Policies

- Ask for discounts: Inquire about additional discounts or promotions available for bundling multiple policies with the same insurance provider.

- Highlight your loyalty: Emphasize your commitment to a long-term relationship with the insurance company to negotiate better rates for your bundled policies.

- Review your coverage regularly: Stay informed about changes in your insurance needs and coverage options. Periodically review your bundled policies to ensure you are still getting the best deal.

Last Recap

In conclusion, Bundled Auto Insurance Plans offer a convenient way to save on insurance costs while streamlining your coverage. Consider the pros and cons carefully to make an informed decision that suits your needs.

FAQ Overview

Are bundled auto insurance plans always cheaper?

While bundled plans can often lead to cost savings, it's essential to compare prices with standalone policies to ensure you're getting the best deal.

Can I customize my coverage with bundled auto insurance plans?

Typically, bundled plans offer limited customization options compared to standalone policies. However, you may still be able to adjust certain aspects of your coverage.

What happens if I want to cancel one policy in a bundled package?

If you decide to cancel one policy in a bundled package, it may affect the overall cost savings and benefits you were receiving. It's important to review the terms and conditions before making any changes.