Comparing Traditional vs Group-Based Car Insurance Models sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. As we delve into the intricacies of both models, we uncover a world where choices can significantly impact one's insurance experience.

As we navigate through the comparison of these two distinct approaches to car insurance, we unravel a tapestry of insights that shed light on the nuances of each model.

Traditional Car Insurance Model

In the traditional car insurance model, policyholders pay premiums to an insurance company in exchange for coverage in case of accidents, theft, or other damages to their vehicles.Key Features of Traditional Car Insurance

- Policyholders pay premiums on a regular basis.

- Coverage includes liability, collision, comprehensive, and other optional coverages.

- Insurance companies assess risk based on factors like driving history, age, and type of vehicle.

- Deductibles may apply before insurance coverage kicks in.

Advantages and Disadvantages of Traditional Car Insurance

- Advantages:

- Provides financial protection in case of accidents or damages.

- Offers peace of mind to drivers knowing they are covered.

- Allows for customization with optional coverages.

- Disadvantages:

- Premiums can be expensive, especially for high-risk drivers.

- Claims process may be slow and bureaucratic.

- Policyholders may face premium increases after filing claims.

Process of Filing a Claim in a Traditional Car Insurance Model

When a policyholder needs to file a claim in a traditional car insurance model, they typically follow these steps:- Contact the insurance company to report the incident.

- Provide necessary documentation, such as a police report or photos of the damage.

- Wait for the insurance company to assess the claim and determine coverage.

- If approved, the insurance company will provide compensation for repairs or replacements.

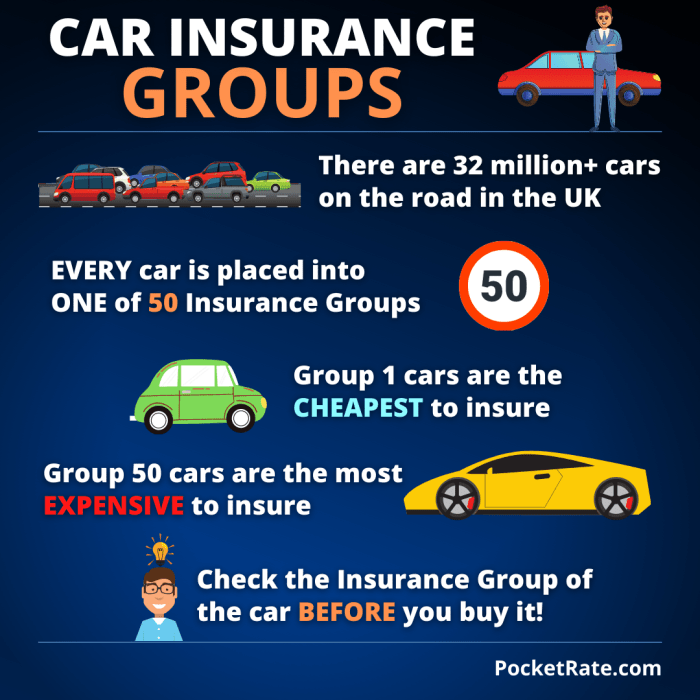

Group-Based Car Insurance Model

Group-based car insurance is a model where individuals with similar characteristics or belonging to the same group, such as employees of a company or members of an organization, pool their insurance policies together. This model allows for shared risk and potentially lower premiums for members of the group.Examples of Group-Based Car Insurance Models

- Professional Associations: Members of professional associations may be eligible for group-based car insurance policies tailored to their specific industry.

- Employer-Based Insurance: Some companies offer group car insurance plans to their employees as a benefit, taking advantage of group discounts.

- Membership Organizations: Organizations like alumni groups or clubs may negotiate group car insurance rates for their members.

Benefits of Group-Based Insurance vs Traditional Models

- Lower Premiums: Group-based insurance often comes with discounted rates due to the shared risk among members of the group.

- Customized Policies: Group-based models can offer policies tailored to the specific needs of the group, providing more personalized coverage options.

- Community Support: Being part of a group can provide a sense of community and support in case of accidents or claims.

Calculating Risk in Group-Based Car Insurance

In group-based car insurance, risk is calculated based on the collective risk profile of the entire group rather than individual factors. Insurance companies analyze the demographic and behavioral data of the group as a whole to determine the overall risk level. This shared risk approach can lead to more competitive rates for members of the group.Premium Determination

Car insurance premiums play a crucial role in determining the cost of coverage for policyholders. Understanding how premiums are determined in traditional and group-based car insurance models can provide insight into the factors influencing pricing and potential cost savings.When it comes to traditional car insurance models, premiums are typically calculated based on individual risk factors such as age, driving history, location, type of vehicle, and credit score. Insurers assess the likelihood of a policyholder filing a claim and adjust premiums accordingly. This personalized approach can result in higher premiums for drivers deemed to be higher risk.

Car insurance premiums play a crucial role in determining the cost of coverage for policyholders. Understanding how premiums are determined in traditional and group-based car insurance models can provide insight into the factors influencing pricing and potential cost savings.When it comes to traditional car insurance models, premiums are typically calculated based on individual risk factors such as age, driving history, location, type of vehicle, and credit score. Insurers assess the likelihood of a policyholder filing a claim and adjust premiums accordingly. This personalized approach can result in higher premiums for drivers deemed to be higher risk.Factors Influencing Premiums

In traditional car insurance models, premiums are influenced by individual risk factors, leading to personalized pricing for each policyholder- Traditional Car Insurance Model:

- Individual risk factors

- Driving history

- Location

- Type of vehicle

- Credit score

- Group-Based Car Insurance Model:

- Overall risk profile of the group

- Claims history

- Collective bargaining power

Lower Premiums in Group-Based Models

Group-based car insurance models have the potential to offer lower premiums compared to traditional models due to the shared risk and cost distribution among group members. By leveraging the collective bargaining power of the group, insurers can negotiate better rates with the promise of a larger pool of policyholders. This can result in cost savings for individual policyholders who may benefit from reduced premiums based on the overall performance of the group.Group-based insurance models can provide cost savings through shared risk and collective bargaining power, leading to lower premiums for policyholders.

Additional Costs

While group-based insurance models can offer lower premiums, there may be additional costs associated with membership in the group. Some group-based insurance programs require membership fees or participation in specific activities to qualify for coverage. It's important for policyholders to carefully consider any additional costs associated with group-based insurance to ensure that the overall savings outweigh the expenses.Customer Experience

Customer experience plays a crucial role in determining the satisfaction and loyalty of policyholders in the car insurance industry. Let's explore how traditional and group-based car insurance models impact the overall customer experience.

Customer experience plays a crucial role in determining the satisfaction and loyalty of policyholders in the car insurance industry. Let's explore how traditional and group-based car insurance models impact the overall customer experience.Traditional Car Insurance Experiences

Customer feedback on traditional car insurance experiences often revolves around the perceived lack of personalized service and slow claims processing times. Policyholders may feel disconnected from their insurance provider and frustrated with the overall customer service experience. For example, customers have reported long wait times when contacting customer support and difficulty in getting their claims approved promptly.Customer Service in Traditional vs Group-Based Insurance

In traditional car insurance models, customer service tends to be more transactional, with limited opportunities for personalized interactions. On the other hand, group-based insurance models often emphasize community and peer support, allowing policyholders to engage with other members of the group. This can lead to a more collaborative and supportive customer service experience.Customer Satisfaction Examples

In traditional car insurance, customer satisfaction may vary depending on the insurer's responsiveness to claims and inquiries. However, in group-based insurance models, policyholders often report higher levels of satisfaction due to the sense of belonging to a community and the shared values with other group members.Impact on Customer Loyalty

The type of insurance model can significantly impact customer loyalty. Traditional insurance companies may struggle to retain customers who are seeking a more personalized and engaging experience. In contrast, group-based insurance models that foster a sense of community and mutual support can lead to higher levels of customer loyalty and retention.Summary

In conclusion, the exploration of Traditional vs Group-Based Car Insurance Models reveals a landscape where innovation meets tradition, and customers are faced with a myriad of options to safeguard their vehicles. Whether opting for the tried-and-tested path of traditional insurance or embracing the collaborative spirit of group-based models, individuals can now make informed decisions that align with their preferences and priorities.

Clarifying Questions

How are premiums calculated in traditional car insurance?

Premiums in traditional car insurance are determined based on factors such as the driver's age, driving history, type of vehicle, and location. Insurers use actuarial data to assess risk and set premium rates accordingly.

What are the benefits of group-based car insurance compared to traditional models?

Group-based car insurance models often offer lower premiums due to the pooling of risk among members of the group. This can result in cost savings for policyholders while maintaining adequate coverage.

How does customer service differ between traditional and group-based insurance?

Traditional insurance companies typically offer personalized customer service tailored to individual policyholders, while group-based insurance may provide more standardized services to all members of the group.