Delving into the realm of car insurance models, this analysis sheds light on the differences between traditional and group-based approaches. Get ready for an informative journey filled with insights that will help you navigate the complexities of choosing the right insurance model for your needs.

Exploring pricing, coverage, and customer experience, this comparison aims to provide a holistic view of the two models and empower you to make informed decisions.

Traditional Car Insurance Model vs. Group-Based Car Insurance Model

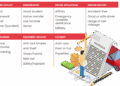

The traditional car insurance model and the group-based car insurance model are two common approaches to securing coverage for your vehicle. Each model has its own set of characteristics, benefits, and drawbacks that cater to different preferences and needs. Let's explore the key differences between these two models.Traditional Car Insurance Model

The traditional car insurance model involves individuals purchasing insurance policies directly from insurance companies. Pricing in this model is typically based on individual risk factors such as driving record, age, and location. Coverage options can be customized to suit the specific needs of the policyholder, ranging from basic liability coverage to comprehensive coverage that includes additional benefits like roadside assistance and rental car reimbursement.Group-Based Car Insurance Model

In contrast, the group-based car insurance model involves policyholders joining a group or association to access insurance coverage collectively. Pricing in this model is often based on the group's overall risk profile, which can result in lower premiums for members who are considered lower risk. Coverage options in a group-based model may be standardized for all members, offering a set package of benefits that may be less customizable compared to traditional insurance plans.Advantages and Disadvantages

- Traditional Car Insurance Model:

- Advantages:

- Customizable coverage options tailored to individual needs.

- Potential for discounts based on individual circumstances.

- Disadvantages:

- Higher premiums for higher-risk individuals.

- Limited cost-saving benefits for low-risk individuals.

- Advantages:

- Group-Based Car Insurance Model:

- Advantages:

- Potential for lower premiums through group risk pooling.

- Simplified coverage options for all members.

- Disadvantages:

- Lack of customization for individual coverage needs.

- Potential for limited flexibility in policy terms.

- Advantages:

Pricing Strategies

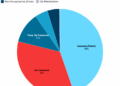

Traditional car insurance companies and group-based car insurance models employ different pricing strategies that can significantly impact consumers' decisions when choosing between the two options.Risk Assessment and Pooling of Resources

In the traditional car insurance model, pricing is typically based on individual risk factors such as age, driving history, and location. Insurance companies assess the risk associated with insuring each individual driver and determine premiums accordingly. This personalized approach to pricing can result in higher premiums for drivers with a higher perceived risk.On the other hand, group-based car insurance models rely on pooling resources from a group of policyholders. By spreading the risk across a larger pool of individuals, group-based insurers can offer lower premiums to their members. Pricing in these models is based on the collective risk profile of the group rather than individual characteristics, resulting in more affordable rates for many policyholders.Real-World Examples

For example, a young driver with a limited driving history and a few traffic violations may face high premiums with a traditional car insurance company due to their individual risk profile. In contrast, the same driver could potentially access more affordable rates through a group-based car insurance model that takes into account the overall risk profile of the group.Similarly, a family with multiple drivers of varying ages and driving experience may find that group-based car insurance offers better value compared to traditional insurers. By pooling their resources with other policyholders, they can benefit from lower premiums based on the collective risk profile of the group.Overall, the pricing strategies employed by traditional car insurance companies and group-based models can have a significant impact on consumers' decisions when selecting an insurance provider. Factors such as individual risk assessment versus pooled resources play a crucial role in determining the affordability and value of insurance coverage for policyholders.Coverage Options

When it comes to choosing an insurance plan for your vehicle, understanding the coverage options available is crucial. Let's delve into the typical coverage options offered by traditional car insurance providers and group-based car insurance models, comparing their flexibility and impact on policyholder satisfaction.Coverage Options Comparison

In the traditional car insurance model, policyholders have the flexibility to customize their coverage based on individual needs. This may include options such as liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and personal injury protectionCustomer Experience

When it comes to customer experience, traditional and group-based car insurance models offer different approaches in terms of customer service, claim processing, and overall satisfaction.

Customer Service

Traditional car insurance models typically provide customer service through a dedicated agent who handles all inquiries and policy changes. This personalized approach can be beneficial for customers who prefer a direct point of contact. On the other hand, group-based car insurance models often rely on digital platforms or call centers for customer service, which may offer quicker response times but lack the personal touch of a dedicated agent.

Claim Processing

In terms of claim processing, traditional car insurance models may involve more paperwork and longer processing times due to the manual nature of the process. Group-based car insurance models, on the other hand, often streamline the claim process through online platforms, making it faster and more efficient for customers to file and track their claims.

Overall Satisfaction

Customer satisfaction can vary between traditional and group-based car insurance models. Some customers prefer the personalized service and relationship-building aspect of traditional models, while others appreciate the convenience and efficiency of group-based models. Reviews and feedback from customers highlight both positive and negative experiences with each type of insurance provider, emphasizing the importance of finding the right fit for individual needs and preferences.

Last Recap

As we wrap up our discussion on Comparing Traditional vs Group-Based Car Insurance Models, remember that the choice between these models ultimately boils down to your individual preferences and needs. Whether you opt for the reliability of a traditional model or the community-driven approach of a group-based one, ensure that you select the model that best aligns with your insurance requirements and budget.

Q&A

What are the key differences between traditional and group-based car insurance models?

The traditional model offers individual policies based on risk assessment, while the group-based model pools resources to offer collective coverage.

How do pricing strategies differ between traditional and group-based car insurance models?

Traditional models assess risk individually, leading to personalized pricing, whereas group-based models distribute costs among members, often resulting in lower premiums.

What coverage options are typically offered by traditional car insurance providers and group-based models?

Traditional providers offer customizable coverage based on individual needs, while group-based models provide standardized coverage to all members.

How does customer experience vary between traditional and group-based car insurance models?

Traditional models may offer more personalized service but group-based models often focus on community support and shared resources.