Delving into the realm of Consumer Trends in Vehicle Protection and Insurance, this introductory passage aims to captivate readers with a blend of knowledge and originality, setting the stage for an enlightening exploration of the topic.

The subsequent paragraph will provide a detailed and informative overview of the subject matter.

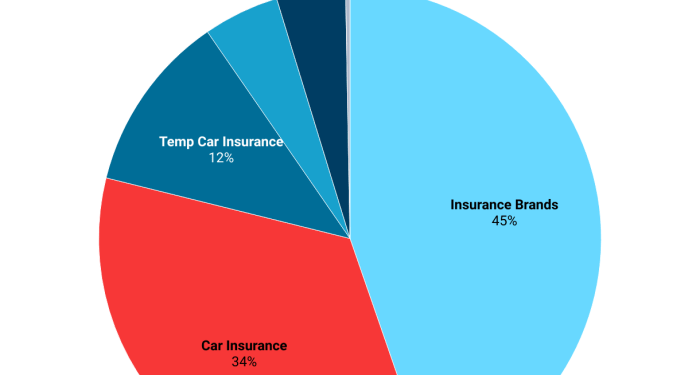

Overview of Vehicle Protection and Insurance Trends

The landscape of vehicle protection and insurance is constantly evolving, influenced by various factors that shape consumer behavior in this sector. Technological advancements play a significant role in driving changes and shaping consumer preferences.Key Factors Driving Changes in Consumer Behavior

- Increased awareness of the importance of vehicle protection and insurance due to rising incidents of theft and accidents.

- Desire for comprehensive coverage to safeguard against unforeseen circumstances and potential financial losses.

- Shift towards usage-based insurance models, where premiums are based on individual driving behaviors.

- Rising demand for telematics devices that provide real-time data for insurance purposes and promote safe driving habits.

Impact of Technological Advancements

- Integration of AI and machine learning algorithms for personalized insurance offerings tailored to individual needs and risk profiles.

- Adoption of blockchain technology to enhance data security, streamline claims processing, and prevent fraud in the insurance sector.

- Growth of Insurtech startups offering innovative solutions such as on-demand insurance and peer-to-peer insurance platforms.

- Development of connected car technologies that enable vehicles to communicate with insurance providers for proactive risk management.

Evolving Customer Expectations

Customer expectations in the vehicle protection and insurance industry have significantly evolved over the years. In the past, customers were mainly focused on basic coverage and affordable premiums. However, with advances in technology and a shift towards personalized experiences, customers now expect more from their insurance providers.Personalized Insurance Offerings

- Traditional insurance models offered one-size-fits-all policies, but customers now seek personalized offerings tailored to their specific needs and preferences.

- Companies are leveraging data analytics and AI to create custom insurance plans that consider factors like driving behavior, vehicle usage, and individual risk profiles.

- Personalized offerings not only provide customers with more comprehensive coverage but also help in building trust and loyalty.

Customer Feedback and Reviews

- Customer feedback and reviews play a crucial role in shaping customer expectations and influencing their decision-making process.

- Insurance companies are increasingly relying on feedback platforms to gather insights and improve their services based on customer preferences and pain points.

- Positive reviews can act as a powerful marketing tool, attracting new customers and enhancing the overall reputation of the company.

Shift Towards Digital Platforms

The automotive industry has seen a significant shift towards digital platforms for purchasing vehicle protection and insurance. With the increasing reliance on technology in our daily lives, consumers are now more inclined to use online tools and apps to make informed decisions about their insurance needs.Role of Online Comparison Tools and Apps

Online comparison tools and apps play a crucial role in helping consumers compare different insurance options easily and efficiently. These platforms allow users to input their preferences and requirements, and then generate a list of insurance providers with relevant offerings. By providing side-by-side comparisons of coverage, pricing, and customer reviews, these tools empower consumers to make the best choice for their specific needs.- One popular example is Compare.com, which allows users to compare quotes from multiple insurance companies in just minutes. This platform streamlines the process of shopping for insurance and helps users save time and money.

- Another successful app is Gabi, which uses artificial intelligence to analyze a customer's current insurance policy and compare it with offers from other providers. This personalized approach has proven to be effective in helping customers find better deals.

Successful Digital Strategies by Companies

Insurance companies have been leveraging digital strategies to attract and retain customers in this competitive landscape. One effective strategy is the use of targeted online advertising to reach potential customers at the right moment. By analyzing consumer behavior and preferences, companies can tailor their ads to specific demographics, increasing the likelihood of conversionProgressive Insurance is a prime example of a company that has successfully used digital marketing to reach its target audience. Their humorous and relatable ads have resonated with consumers, leading to increased brand awareness and customer loyalty.

- Another successful digital strategy is the implementation of user-friendly mobile apps that allow customers to manage their policies, file claims, and access support services conveniently. These apps enhance the overall customer experience and encourage long-term relationships with the company.

- Geico's mobile app, for instance, offers features such as digital ID cards, roadside assistance requests, and bill payments, making it easier for customers to interact with the company on the go.

Customization and Personalization

In the realm of vehicle protection and insurance, customization and personalization play a crucial role in meeting individual customer needs and preferences. Tailoring products and services to match specific requirements not only enhances the overall customer experience but also fosters a sense of loyalty and satisfaction.Data Analytics for Tailored Offerings

Companies are increasingly leveraging data analytics to gain deeper insights into customer behavior, preferences, and risk profiles. By analyzing vast amounts of data, insurers can identify patterns and trends, allowing them to create personalized offerings that align with each customer's unique circumstances. This level of customization not only ensures that customers receive the coverage they need but also helps in optimizing pricing and reducing risks for both parties.- Utilizing customer data to assess risk levels accurately

- Developing personalized coverage plans based on individual driving habits

- Offering discounts and rewards tailored to specific customer profiles

Personalized services based on data insights can lead to a significant increase in customer satisfaction and loyalty.

Impact on Customer Loyalty

The implementation of personalized services has a direct impact on customer loyalty and retention. When customers feel that their insurance provider understands their unique needs and offers tailored solutions, they are more likely to stay loyal to the brand. Personalization creates a sense of trust and reliability, making customers feel valued and appreciated.- Enhanced customer satisfaction through personalized services

- Increased customer retention rates and reduced churn

- Positive word-of-mouth referrals and recommendations

Final Wrap-Up

Concluding this discussion on Consumer Trends in Vehicle Protection and Insurance, this final paragraph will offer a compelling summary and closing thoughts to wrap up the exploration.

FAQ Corner

What are some key factors driving changes in consumer behavior in vehicle protection and insurance?

Some key factors include technological advancements, shifting customer expectations, and the emphasis on customization and personalization.

How do customer feedback and reviews impact decision-making in the vehicle protection and insurance industry?

Customer feedback and reviews play a significant role in influencing decisions by providing insights into the quality of services and customer satisfaction levels.

What role do online comparison tools and apps play in helping consumers make informed decisions about vehicle protection and insurance?

Online comparison tools and apps assist consumers in comparing different insurance options, coverage, and prices, enabling them to make well-informed choices.

How are companies leveraging data analytics to tailor offerings to individual customer needs in vehicle protection and insurance?

Companies use data analytics to analyze customer preferences and behavior, allowing them to customize insurance products and services to meet individual needs effectively.

What is the significance of personalized services on customer loyalty and retention in the vehicle protection and insurance sector?

Personalized services enhance customer loyalty and retention by creating a more tailored and engaging experience, fostering long-term relationships with customers.