Delving into the realm of auto insurance pricing, this piece explores the transformative impact of technology in reshaping the industry landscape. From cutting-edge innovations to dynamic pricing strategies, the evolution is palpable and promises a fascinating journey ahead.

As we unravel the intricate web of technology's influence on auto insurance pricing, a clearer picture emerges of the vast possibilities and implications at play.

Impact of Technology on Auto Insurance Pricing

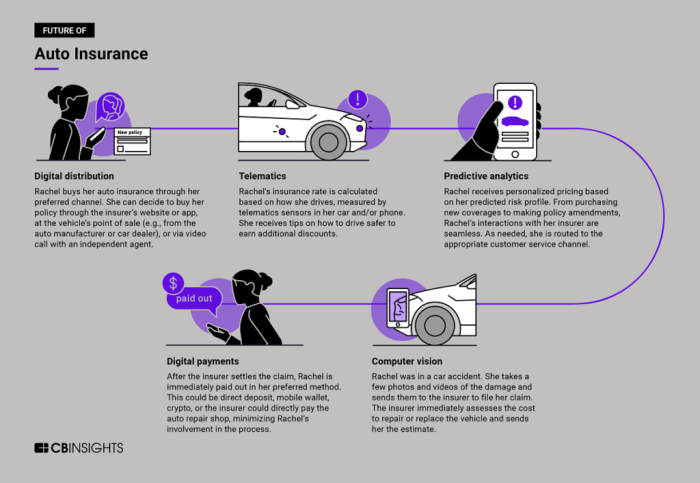

Technology has played a significant role in revolutionizing auto insurance pricing, allowing for more accurate and personalized rates based on individual driving habits and risk factors. By leveraging advanced technologies, insurance companies can now assess risk more effectively and adjust pricing accordingly.Telematics Devices

Telematics devices, such as GPS trackers and onboard diagnostics, have enabled insurers to collect real-time data on driving behaviors like speed, mileage, braking patterns, and time of day. This data allows for a more accurate assessment of risk, leading to personalized pricing based on actual driving habits.Usage-Based Insurance (UBI)

Usage-Based Insurance (UBI) programs utilize telematics data to offer policyholders discounts based on their driving behavior. Safe drivers are rewarded with lower premiums, while risky drivers may see an increase in rates. This dynamic pricing model encourages safer driving habits and allows for fairer pricing based on individual risk profiles.Artificial Intelligence (AI) and Machine Learning

Artificial Intelligence (AI) and Machine Learning algorithms analyze vast amounts of data to predict risk factors and determine appropriate pricing strategies. These technologies can identify patterns and correlations that human underwriters may overlook, resulting in more accurate pricing and better risk management.Data Analytics

Data analytics tools enable insurers to process and analyze large volumes of data quickly, leading to more informed pricing decisions. By identifying trends and patterns in driving behavior, insurers can adjust rates in real-time and offer personalized quotes based on individual risk profiles.Mobile Apps and Online Platforms

Mobile apps and online platforms have made it easier for customers to access insurance information, file claims, and manage their policies. These digital tools also provide insurers with valuable data on customer behavior and preferences, allowing for more targeted pricing strategies and personalized offerings.Telematics and Usage-Based Insurance

Telematics technology has revolutionized the way auto insurance pricing is determined, allowing for a more personalized approach based on individual driving habits. This has led to the rise of usage-based insurance programs that utilize telematics data to calculate premiums.

Telematics technology has revolutionized the way auto insurance pricing is determined, allowing for a more personalized approach based on individual driving habits. This has led to the rise of usage-based insurance programs that utilize telematics data to calculate premiums.Definition of Telematics and Its Significance

Telematics refers to the use of devices installed in vehicles to collect data on driving behavior, such as speed, acceleration, braking, and mileage. This data is then used by insurance companies to assess risk more accurately and set premiums accordingly. By analyzing real-time data, insurers can offer more personalized pricing based on how a driver actually uses their vehicle.How Usage-Based Insurance Programs Utilize Telematics Data

Usage-based insurance programs, also known as pay-as-you-drive or pay-how-you-drive, rely on telematics devices to track and monitor a policyholder's driving habits. Insurers can then adjust premiums based on actual data, rewarding safe drivers with lower rates and providing incentives for improved driving behavior. This approach shifts the focus from traditional rating factors to individual driving performance.Benefits and Challenges of Using Telematics for Pricing Auto Insurance

- Benefits:

- More accurate pricing: Telematics data allows for a more precise assessment of risk, leading to fairer premiums based on actual driving behavior.

- Encourages safe driving: By offering discounts for safe driving habits, telematics incentivize policyholders to adopt safer behaviors on the road.

- Customized coverage: Usage-based insurance programs can tailor coverage to individual drivers, providing a more personalized insurance experience.

- Challenges:

- Privacy concerns: Collecting real-time data on driving habits raises privacy issues for some policyholders who may be wary of constant monitoring.

- Data accuracy: The reliability of telematics data can be affected by various factors, such as device malfunctions or inaccuracies in measuring driving behavior.

- Implementation costs: Installing and maintaining telematics devices can be costly, posing a barrier to widespread adoption of usage-based insurance programs.

Artificial Intelligence and Machine Learning

AI and machine learning algorithms are transforming the landscape of auto insurance pricing by providing insurers with powerful tools to analyze vast amounts of data and make more accurate risk assessments. These technologies enable insurance companies to set premiums based on individual driving behavior and other relevant factors, rather than relying on traditional demographic information.Accuracy and Efficiency Improvements

- AI algorithms can analyze data from telematics devices and other sources to assess risk factors in real-time, allowing insurers to offer personalized premiums tailored to each driver's behavior.

- Machine learning models can detect patterns and trends in data that human analysts may overlook, leading to more precise risk predictions and pricing strategies.

- By automating the underwriting process, AI can streamline operations, reduce human error, and improve overall efficiency in pricing auto insurance policies.

Examples of AI Applications

- Usage-based insurance programs utilize AI to track driving habits, such as speed, braking, and acceleration, to adjust premiums based on actual behavior rather than statistical averages.

- Claims processing systems powered by machine learning can analyze accident data and assess the likelihood of fraud, helping insurers make faster and more accurate claim decisions.

- AI-driven chatbots and virtual assistants are being used to provide customer support, answer inquiries, and facilitate policy management, enhancing the overall customer experience in the insurance industry.

Data Analytics and Predictive Modeling

Data analytics plays a pivotal role in transforming the auto insurance industry by providing insurers with valuable insights into risk assessment and pricing strategies. Predictive modeling, on the other hand, allows insurers to forecast future claims and adjust premiums accordingly. Let's delve deeper into how these technologies are shaping the landscape of auto insurance pricing.

Data analytics plays a pivotal role in transforming the auto insurance industry by providing insurers with valuable insights into risk assessment and pricing strategies. Predictive modeling, on the other hand, allows insurers to forecast future claims and adjust premiums accordingly. Let's delve deeper into how these technologies are shaping the landscape of auto insurance pricing.Role of Data Analytics in Risk Assessment

Data analytics enables insurers to analyze vast amounts of data, including driver behavior, vehicle information, and claim history, to assess risk more accurately. By leveraging advanced analytics tools, insurers can identify patterns and trends that help them make informed decisions when setting prices for auto insurance policies.

Significance of Predictive Modeling in Premium Adjustments

Predictive modeling uses historical data and statistical algorithms to predict future claim frequency and severity. Insurers can use these predictions to adjust premiums based on the level of risk associated with individual policyholders. This proactive approach allows insurers to offer more personalized pricing, reflecting the actual risk profile of each customer.

Ethical Implications of Data Analytics in Auto Insurance Pricing

While data analytics offers numerous benefits in terms of risk assessment and pricing accuracy, it also raises ethical concerns regarding customer privacy and fairness. Insurers must ensure that the data they collect and analyze is used responsibly and transparently, avoiding discriminatory practices that could unfairly impact certain policyholders. Striking a balance between data-driven decision-making and ethical considerations is crucial in the evolving landscape of auto insurance pricing.

Wrap-Up

In conclusion, the dynamic interplay between technology and auto insurance pricing unveils a future where precision, personalization, and innovation reign supreme. As we embrace these changes, the road ahead is paved with endless opportunities to redefine the very fabric of insurance pricing.

FAQ Corner

What role does telematics play in auto insurance pricing?

Telematics is instrumental in shaping auto insurance pricing by leveraging real-time data on driving behavior to assess risk and determine premiums.

How does AI revolutionize auto insurance pricing?

AI and machine learning algorithms enhance accuracy and efficiency in predicting risk, enabling insurers to adjust premiums based on real-time data analysis.

What are the benefits of using data analytics in auto insurance pricing?

Data analytics transform risk assessment and pricing by providing insights into future claims, allowing insurers to adjust premiums accordingly for a more personalized approach.