Exploring the realm of comprehensive car insurance policies unveils a world of protection beyond the basics. From safeguarding against unforeseen incidents to offering additional coverage options, the depth of a truly comprehensive policy is unmatched. Let's delve into the key elements that make these policies essential for every driver.

What Makes a Car Insurance Policy Truly Comprehensive?

When it comes to car insurance, having a truly comprehensive policy can make all the difference in ensuring you are adequately protected in various situations. Here are key features that a comprehensive car insurance policy should include:

Key Features of a Comprehensive Car Insurance Policy:

- Collision Coverage: This helps pay for repairs or replacement of your vehicle if you are involved in an accident with another vehicle or object.

- Comprehensive Coverage: Protects your vehicle from non-collision incidents such as theft, vandalism, or natural disasters.

- Liability Coverage: Covers costs if you are at fault in an accident that causes property damage or injuries to others.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you are in an accident with a driver who has insufficient or no insurance.

Examples of Situations Where Comprehensive Policy Offers Better Coverage:

- If your car is stolen, a comprehensive policy will cover the cost of replacing the vehicle, whereas a basic policy would not offer this protection.

- In case of damage from a natural disaster like a hailstorm, comprehensive coverage would help cover the repairs, which may not be included in a basic policy.

Importance of Additional Coverage Options:

Aside from the basic coverage, additional options like:

- Roadside Assistance: Provides help if your car breaks down, runs out of gas, or needs a tow.

- Rental Car Coverage: Helps cover the cost of a rental car while your vehicle is being repaired after an accident.

- Gap Insurance: Covers the difference between what you owe on your car loan and the actual cash value of the vehicle if it is totaled.

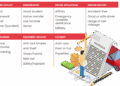

Coverage Details in a Comprehensive Car Insurance Policy

When it comes to a comprehensive car insurance policy, it is important to understand the various coverage details that are included. Let's delve into the specifics of how a comprehensive policy offers protection against a range of incidents beyond just collisions.

When it comes to a comprehensive car insurance policy, it is important to understand the various coverage details that are included. Let's delve into the specifics of how a comprehensive policy offers protection against a range of incidents beyond just collisions.Liability Coverage

- Liability coverage in a comprehensive car insurance policy helps cover costs associated with damages or injuries to others in an accident where you are at fault.

- This coverage typically includes property damage liability and bodily injury liability.

- It is important to note that liability coverage does not cover damages to your own vehicle.

Collision Coverage

- Collision coverage helps pay for damages to your own vehicle in the event of a collision with another vehicle or object.

- This coverage is optional but can be beneficial, especially if your vehicle is newer or more valuable.

- Collision coverage typically comes with a deductible that you must pay before the insurance kicks in.

Comprehensive Coverage

- Comprehensive coverage protects your vehicle against non-collision incidents such as theft, vandalism, natural disasters, and falling objects.

- This coverage is also optional but can provide valuable protection for a variety of unexpected events.

- Similar to collision coverage, comprehensive coverage also comes with a deductible that you need to meet before the insurance covers the rest of the cost.

Comparing Coverage Limits and Deductibles

- Comprehensive insurance often has lower deductibles compared to collision coverage, making it more cost-effective for certain types of claims.

- It is essential to review the coverage limits and deductibles of each type of insurance to determine the best fit for your needs and budget.

- Keep in mind that comprehensive coverage typically has a broader range of protection compared to collision or liability-only insurance.

Factors Influencing Comprehensive Car Insurance Premiums

When it comes to comprehensive car insurance, several factors come into play that can influence the cost of your premium. Understanding these factors can help you make informed decisions when selecting a policy and potentially lower your insurance costs.

Type of Vehicle

The type of vehicle you drive can significantly impact your comprehensive insurance premium. High-end luxury cars or sports cars typically cost more to insure due to their higher repair and replacement costs. On the other hand, older or more affordable vehicles may have lower premiums since they are less expensive to repair or replace.

Driver's Age and Record

Your age and driving record are crucial factors that insurance companies consider when calculating your premium. Younger drivers or drivers with a history of accidents or traffic violations are generally deemed higher risk, resulting in higher premiums. Conversely, older drivers with clean records may enjoy lower insurance costs.

Location

Where you live plays a significant role in determining your comprehensive insurance premium. Urban areas with higher rates of accidents, theft, or vandalism may result in higher premiums compared to rural areas with lower risk factors. Additionally, living in regions prone to natural disasters or extreme weather conditions can also impact your premium.

Coverage Limits

The coverage limits you choose for your comprehensive car insurance policy can also affect your premium. Opting for higher coverage limits means more protection but comes with a higher cost. On the other hand, selecting lower coverage limits may reduce your premium but leave you vulnerable to potential expenses in case of a claim.

Tips to Lower Premiums

- Consider increasing your deductible amount to lower your premium, but ensure you can afford the out-of-pocket expenses in case of a claim.

- Bundle your car insurance with other policies, such as homeowners or renters insurance, to potentially qualify for multi-policy discounts.

- Take advantage of discounts offered by insurance companies for factors like safe driving habits, anti-theft devices, or completing a defensive driving course.

- Regularly review and update your policy to ensure you are not paying for coverage you no longer need, such as comprehensive coverage on an older vehicle.

Claims Process and Customer Service for Comprehensive Car Insurance

When it comes to comprehensive car insurance, the claims process and customer service play a crucial role in ensuring a smooth experience for policyholders. Let's delve into how these aspects impact the overall satisfaction of customers.Claims Process for Filing a Comprehensive Insurance Claim

- After an accident or damage to your vehicle, contact your insurance provider immediately to initiate the claims process.

- Your insurer will assign a claims adjuster to assess the damage and determine the coverage under your comprehensive policy.

- You may need to provide documentation such as police reports, photos of the damage, and repair estimates to support your claim.

- Once the claim is approved, the insurance company will arrange for repairs or reimbursement for the damages covered under your policy.

Role of Customer Service in Handling Claims

- Customer service representatives play a vital role in guiding policyholders through the claims process and answering any questions they may have.

- They help policyholders understand their coverage, rights, and responsibilities during the claims process.

- Customer service teams ensure timely communication and updates on the status of the claim, fostering trust and transparency with policyholders.

Positive Customer Experiences with Comprehensive Car Insurance Companies

- Many policyholders have shared positive experiences with comprehensive car insurance companies, citing quick and hassle-free claims processing.

- Customers appreciate the personalized support and guidance provided by customer service representatives during stressful situations like accidents.

- Some insurers offer convenient online claims processing platforms, making it easier for policyholders to submit documentation and track the progress of their claims.

- Policyholders have praised insurers for their prompt settlement of claims and efficient handling of complex situations, leading to high levels of customer satisfaction.

Final Review

In conclusion, a comprehensive car insurance policy goes beyond the ordinary to provide extensive coverage and peace of mind to drivers. By understanding the intricacies of what constitutes a truly comprehensive policy, individuals can make informed decisions to protect their vehicles and finances effectively.

Essential FAQs

What additional coverage options should a comprehensive car insurance policy include?

A comprehensive car insurance policy should ideally offer roadside assistance, rental car coverage, and gap insurance to provide enhanced protection beyond the standard coverage.

How does a comprehensive policy protect against non-collision incidents?

Comprehensive coverage safeguards against theft, vandalism, natural disasters, and other non-collision incidents that can damage or total a vehicle.

What factors influence the cost of a comprehensive car insurance policy?

The cost of comprehensive insurance is influenced by factors such as the type of vehicle, driver's age and record, location, and coverage limits set in the policy.

What is the claims process like for filing a comprehensive insurance claim?

When filing a comprehensive insurance claim, policyholders typically need to provide details of the incident, submit relevant documentation, and work closely with the insurance company to assess and process the claim efficiently.

How can policyholders lower their comprehensive insurance premiums?

To potentially lower comprehensive insurance premiums, policyholders can consider factors like raising deductibles, maintaining a clean driving record, bundling policies, and exploring available discounts offered by insurance providers.