Delving into the realm of auto coverage plans, understanding why transparency plays a vital role is key to navigating the complex landscape of insurance policies. Let's uncover the significance of transparency and how it impacts both policyholders and insurance companies.

Importance of Transparency in Auto Coverage Plans

Transparency in auto coverage plans is crucial for both policyholders and insurance companies. Clear and understandable policies help in avoiding misunderstandings and disputes that may arise due to ambiguity. When policyholders have a transparent understanding of what is covered and what is not, they can make informed decisions about their insurance needs.Avoiding Misunderstandings

Transparency in auto coverage plans can prevent misunderstandings between policyholders and insurance companies. For example, if a policyholder is not aware of certain exclusions or limitations in their coverage, they may face unexpected denials of claims. This can lead to frustration and dissatisfaction with the insurance provider.Building Trust and Loyalty

Clear and transparent coverage plans can help build trust and loyalty with customers. When policyholders feel that the insurance company is honest and upfront about the coverage they offer, they are more likely to renew their policies and recommend the company to others. This trust can strengthen the relationship between the policyholder and the insurance provider, leading to long-term customer retention.Benefits of Transparent Auto Coverage Plans

Transparency in auto coverage plans offers numerous advantages to policyholders, empowering them to make well-informed decisions and navigate the complexities of insurance policies with confidence.

Transparency in auto coverage plans offers numerous advantages to policyholders, empowering them to make well-informed decisions and navigate the complexities of insurance policies with confidence.Empowering Informed Decisions

- Understanding all aspects of an auto insurance policy upfront allows policyholders to choose the coverage that best suits their needs and budget.

- Transparent policies provide clarity on coverage limits, deductibles, exclusions, and other important details, enabling customers to assess the value they are receiving.

Simplified Claims Process

- By clearly outlining the claims process and requirements, transparent coverage plans help policyholders know what to expect in the event of an accident or loss.

- Having a thorough understanding of their policy upfront can streamline the claims process, reducing confusion and delays for customers.

Elements of Transparent Auto Coverage Plans

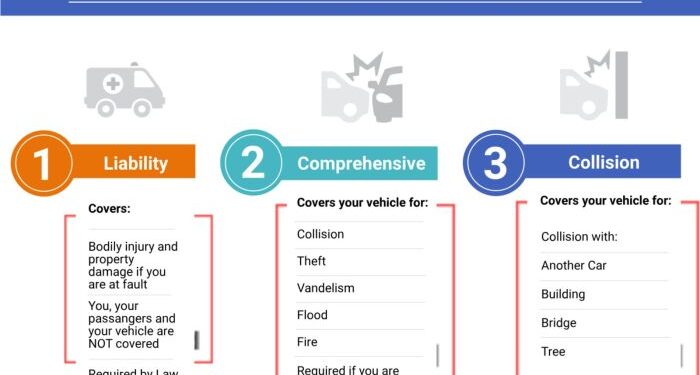

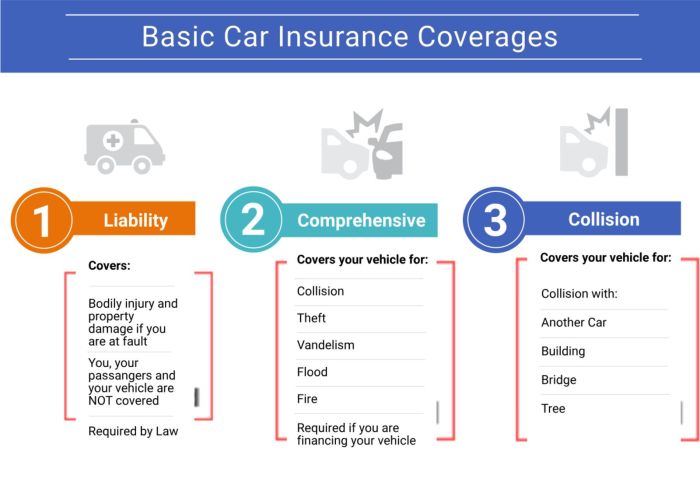

Transparency in auto insurance policies is crucial for customers to fully understand the coverage they are receiving. Clear communication of key information is essential to avoid any confusion or misunderstandings in the event of a claim. Let's explore the key elements that should be clearly communicated in an auto insurance policy.Clear Definition of Coverage Limits

- Insurance policies should clearly state the maximum amount the insurer will pay for covered losses. This helps policyholders understand the extent of their protection and avoid any surprises when filing a claim.

- For example, a policy might specify a liability limit of $100,000 per person and $300,000 per accident. This information allows the insured to make informed decisions about their coverage needs.

Detailed Explanation of Deductibles

- Deductibles are the amount the policyholder must pay out of pocket before the insurance coverage kicks in. Clearly defining the deductible amount helps customers budget for potential expenses in case of a claim.

- For instance, a policy with a $500 deductible means the insured must pay the first $500 of any covered loss before the insurance company starts covering the remaining costs.

Inclusion of Exclusions

- Exclusions Artikel specific situations or circumstances that are not covered by the insurance policy. It is important for policyholders to be aware of these exclusions to avoid any surprises when filing a claim.

- Examples of exclusions could include intentional damage, racing activities, or using the vehicle for commercial purposes. Knowing what is not covered helps customers understand the limitations of their policy.

Additional Benefits and Optional Coverages

- Policy documents should clearly Artikel any additional benefits or optional coverages available for purchase. This allows customers to tailor their insurance policy to meet their specific needs.

- For example, roadside assistance, rental car reimbursement, and comprehensive coverage are often offered as optional add-ons. Providing detailed information on these extras enhances transparency and empowers policyholders to make informed decisions.

Building Trust through Transparency

Transparency in auto coverage plans plays a crucial role in enhancing the relationship between insurers and policyholders. By providing clear and open communication about coverage details, limits, and exclusions, insurers can build trust with their customers. When policyholders feel well-informed and understand what their coverage entails, they are more likely to trust their insurance provider.Enhancing Communication to Prevent Misunderstandings

- Establishing open lines of communication to address any questions or concerns policyholders may have regarding their coverage.

- Regularly updating policyholders on any changes to their coverage or terms and conditions.

- Offering clear explanations of coverage options, deductibles, and premiums to ensure policyholders have a comprehensive understanding of their policy.

Strategies for Improving Transparency in Coverage Plans

- Creating easily accessible and user-friendly policy documents that Artikel coverage details in a clear and concise manner.

- Providing online resources and tools for policyholders to review and compare different coverage options.

- Training customer service representatives to effectively communicate coverage information and assist policyholders in understanding their policies.

Final Thoughts

In conclusion, transparency in auto coverage plans is not just a buzzword; it's a cornerstone for trust and reliability in the insurance industry. By prioritizing transparency, both insurers and policyholders can forge stronger relationships and ensure clarity in every step of the insurance process.

Commonly Asked Questions

Why is transparency important in auto coverage plans?

Transparency is crucial as it helps build trust between policyholders and insurance companies, reduces misunderstandings, and ensures informed decision-making.

How does transparent coverage benefit policyholders?

Transparent coverage plans enable policyholders to understand all aspects of their policy upfront, simplifying the claims process and providing clarity.

What key information should be highlighted in an auto insurance policy for transparency?

An auto insurance policy should clearly define coverage limits, deductibles, exclusions, and additional benefits to ensure transparency.

How can insurance companies improve transparency in their coverage plans?

Insurance companies can enhance transparency by clearly communicating policy details, preventing misunderstandings, and fostering better relationships with policyholders.